Hey! Welcome to Marginal Futility. Here, I share some interesting things I come across, especially related to business, finance and tech. You can find my previous posts here.

You can subscribe below if you wish to receive updates directly in your mailbox. No spam, ever! :) You can also follow me on Twitter here.

(Disclaimer: All views expressed in this blog are mine; and do not, in any way, represent the views of my employer.)

On to today’s post…

<<Business>>

Ads on Netflix

In April 2022, during the post results conference call with analysts, Netflix co-CEO Reed Hastings revealed that he was “open” to offering a lower-priced subscription tier supported by advertising.

This took everyone by surprise, as it was a significant departure from Netflix’s stated position over the past decade, as it built itself into the world’s largest streaming company.

"It's a judgment call… It's a belief we can build a better business, a more valuable business without ads. Advertising looks easy until you get in it."

- Reed Hastings (Sep’20)

I think it’s pretty clear that ads are working for Hulu. Disney is doing it. HBO did it. I don’t think we have a lot of doubt that it works, that all those companies have figured it out. I’m sure we’ll just get in and figure it out as opposed to test it and maybe do it or not do it. So I think we’ll really get in.

- Reed Hastings (Apr’22)

…

So why exactly does Netflix need an ad-supported tier?

First off, Netflix’s growth is slowing down. In Q12022, Netflix reported a loss of around 200,000 customers (its first decline in paid users in more than a decade); and in Q2, it lost around a million more.

Source: Stratechery

And other streaming players are increasingly gaining share at Netflix’s expense.

One of the key challenges to Netflix’s growth is the North American market; where it already has around 75 million subscribers (out of a total ~130mn households). Accounting for widespread password sharing, it can be reasonably inferred that Netflix’s penetration in that market is close to ~70%.

Netflix has been relying on international expansion over the last few years; however, apart from very high levels of competition; it also has to contend with increased price sensitivity in countries like India (which offer a massive subscriber base but significantly lower ARPUs).

The second reason - Netflix now has the priciest streaming service out there. Its middle tier costs $15.49 a month. Every other service offered by major companies is cheaper. Disney, for instance, offers a bundle of Disney+, Hulu and ESPN+ for less than that. Most TV companies offer video-streaming services with cheap ad-supported tiers in addition to more expensive ad-free tiers. By introducing a cheaper tier with ads, Netflix finally has a shot at a segment of customers who were who were flocking to cheaper rivals.

An interesting chart from The Information and Antenna shows how even even long-term subscribers are churning away from Netflix. People who have been subscribers to Netflix for more than three years are accounting for a significantly greater share of cancellations now. Netflix would hope that not only would an ad-supported tier bring in new customers; but also help stem this increasing churn.

…

In July 2022, Netflix announced that it has partnered with Microsoft to launch the ad-supported plan. Microsoft will supply technology to facilitate the placement of video ads on Netflix. Other top contenders for the Netflix partnership included Comcast Corp. and Alphabet Inc.’s Google. However, Microsoft apparently edged them out since it would not compete in streaming with Netflix; while Comcast’s NBCUniversal operates the Peacock streaming service while Google owns YouTube.

…

This week, and much more quickly than what most market participants expected, Netflix announced that it will introduce an advertising-supported plan on Nov. 3, charging $7 a month for a subscription. The lower-priced streaming package will debut in the US and 11 other countries, including Japan, France and Brazil (India not currently in the list.) It will include four to five minutes of commercials per hour and offer a lower video quality than higher-priced tiers. Some programs won’t be available because the company doesn’t have the rights to show them with commercials.

The price gives Netflix a competitive product against similar offerings from newer rivals. It’s $3 a month lower than the price of the ad-backed version of HBO Max and $1 less than the forthcoming Disney+ with commercials.

Over the next few quarters, stakeholders would keenly be observing the impact on net subscription additions, movement in ARPU per customer, and potential churn from higher plans to lower ad-supported plans.

<<Finance>>

The Bullwhip effect

Nassim Taleb, author of The Black Swan, tweeted this back in Sep’21.

For the last several years prior to Covid, retailers have been keeping a fairly stable amount of inventory on their shelves in relation to the demand. For illustration, the below graph shows how the aggregate inventory of US retailers kept as a multiple of sales was close to 1.2 times over several years. Keeping the ratio much above this would result in overstocking (and hurt in terms of unnecessarily high inventory holding costs) and keeping it much below this would lead to potential stock outs (and hurt in terms of lost sales).

However, once Covid hit, demand of several items went through the roof due to a confluence of several factors - people stockpiling certain goods and spending more on certain goods (often because there was more money in hands of people due to several fiscal stimulus measures taken by governments across the world). Adding to this, there were supply chain disruptions, making it tough to manufacture and distribute goods at the same pace as earlier.

After a year though, supply chains began to normalize and inventory levels started getting back to normal. But they didn’t stay at the long-term average, they quickly overshot and today, inventory levels are significantly higher that pre-Covid times.

What a lot of retailers are now realizing is that they built up too much inventory; and in several cases; inventory of the wrong stuff. This can partly be explained by retailers’ mistaken forecast/ belief that consumers would keep up their pandemic-level spending and partly by the Bullwhip effect.

The Bullwhip Effect describes how companies typically respond to a spike in demand by ordering more products than required to hedge against potential continued growing demand and to avoid stockouts. This demand distortion is then passed along and amplified at each stage of the supply chain, with orders to suppliers furthest away from the point of sale far removed from the realistic views of consumer demand.

Source: Macrodesiac

Put simply, when the supply chain experiences even a small disturbance in demand, it often triggers a series of overcorrections that keep growing in magnitude the further you move away from the final source of demand.

The bullwhip effect takes hold in supply chains because long lead times are required to build capacity and significantly increase output. By the time companies reach peak capacity, demand may have stabilized at lower levels, leaving firms with excessive inventory.

Morgan Stanley recently released a note on these growing inventory problems; showing how there is an increased divergence between sales growth and inventory growth, leaving companies with an increasingly inventory problem.

Source: Morgan Stanley

In effect, there is now a twofold problem with inventory - supply chain bottlenecks are clearing while demand for goods is slowing. Because of this, companies will have to decide whether they want to continue holding high level of inventories and face high costs of holding; or whether they want to slash prices and liquidate this excess inventory quickly. Going by actions taken by major retailers, it seems that companies will resort to aggressive discounting to cut prices faster than their peers and move out as much inventory as possible - triggering a race to the bottom - and a significant hit on margins for companies.

I would say there’s going to be a - I hesitate to call it a blood bath, but it’s going to be ugly in terms of the amount of discounting and markdowns.

- Richard Hayne, CEO of Urban Outfitters

Aug’22 Earnings call

But what about the impact on consumers? Bullwhip effect could actually turn out to be a reason for easing inflation; or maybe even disinflation. Michael Burry, the legendary hedge fund investor, certainly thinks so.

Interesting indeed!

<<Tech>>

DALL-E now open to public

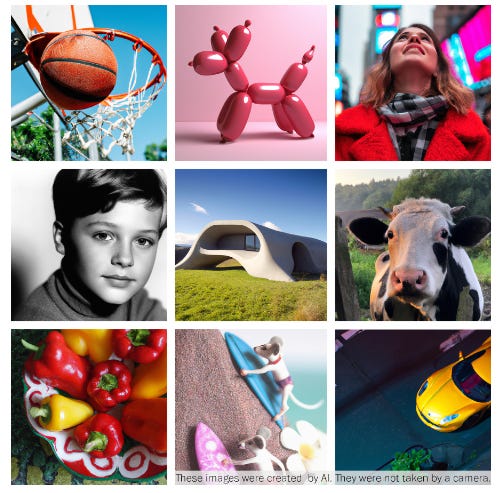

OpenAI has scrapped the wait list for access to its text-to-image system DALL-E 2, meaning anyone can sign up to use the AI art generator immediately.

DALL-E was unveiled in January 2021, with an impressive ability to turn any text description (or prompt) into a unique image.

Source: The Washington Post

None of the above images were taken by a camera; they were all created by the AI tool using text prompts.

The introduction of DALL-E last year led to an explosion of text-to-image generators. Google and Meta both revealed that they had each been developing similar systems. Rival start-ups soon went public, including Stable Diffusion and Midjourney.

DALL-E, and other similar tools, would have significant implications for advertising, media distribution and entertainment.

Here’s what Ark Invest wrote in a recent newsletter:

In our view, tools like DALLE-2 should democratize access to creative content, enabling anyone to generate rich content––including still images, music, and video––instantly at di minimis cost…we estimate that the inference cost for a single image could be ~$0.01––more than 99.99% lower than human labor cost

Based on ARK’s research, AI training costs should decline 60% per year, suggesting that at today’s cost researchers should be able to train models 100x larger within the next five years… If DALLE-2 were to scale 100x, we wonder what other tasks it might be able to accomplish.

Why spend $100,000 on a single television commercial targeting millions of people when, with the same budget, an advertiser will be able to create 10,000 different commercials, each tuned to a cluster of like-minded viewers at a moment in time?

…

This is definitely an innovation of significant economic and societal implications; and I will write more as I learn more about it. For now, enjoy this DALL-E generated image of “Five golden retrievers playing poker” 🙂

Thank you for reading! Please share it with people who you think might find it interesting :)

You can also follow me on Twitter here.