Hey! Welcome to Marginal Futility. Here, I share interesting things I come across, especially related to business, finance and tech. You can find my previous posts here.

You can subscribe below if you wish to receive updates directly in your mailbox. No spam, ever! :) You can also follow me on Twitter here.

On to today’s post…

«Finance»

The state of Venture Capital industry

I recently listened to a very good edition of the All-in Podcast (Ep. 101), where they discussed the state of venture capital industry today.

A couple of interesting charts came up.

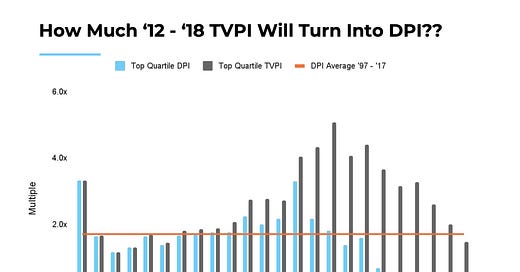

First, a chart denoting top quartile returns of venture capital firms of various vintages (Vintage refers to the year in which a particular fund began making investments).

A few basic explainers on the terms first -

TVPI = Total Value to Paid in capital

where;

Total Value → The cumulative distributions (i.e. realized profits on investments sold) and the residual value (i.e. unrealized potential profits on investments still held)

Paid-In Capital → The quantum of funds raised by the fund from its Limited Partners (‘LPs’). (Note: LPs are the investors in funds - eg endowments, pension funds etc)

DPI = Distribution to Paid in capital

where;

Distribution → Money actually returned by a fund to its investors

…

Hence, taking an example - if a $1bn fund has returned $1.5bn to its investors till date; while having $3bn worth of investments still lying in the fund; its DPI as on date is 1.5/1 = 1.5x and its TVPI is (1.5+3)/1 = 4.5x

…

Considering VC funds typically have a lifecycle of 8-10 years, the TVPI of funds raised in the last few years would majorly consist of on-paper valuations. While the DPI will always lag the TVPI; the eventual goal is to maximize the TVPI while minimizing the eventual difference between TVPI and DPI for each vintage.

Put simply, the goal is to convert the on-paper returns into actual cash returns.

(Note: The reason why blue lines are very small or non-existent for past few years is because funds of those vintages would most probably not have liquidated most or all of their investments yet)

…

Now looking at the chart, a couple of observations:

TVPIs since 2010 are materially higher than what they were a decade back.

The orange line, representing the average DPI over a substantially long 20 year period, is 1.8x

IF actual returns going ahead were to stay close to this; the blue lines will be a LOT shorter than the grey lines for funds of recent vintages.

Hence, a probable conclusion is that there is a high probability of markdowns in the portfolios of a lot of funds.

…

LPs would typically apportion the amount earmarked for VC investments in several funds to diversify their risk. (Just like how on an overall portfolio level, they would diversify by investing in a mix of asset classes like VC, PE, public equities, debt etc).

Now, if there is a risk of markdowns in VC, how should they invest? They would ideally want as little portfolio correlation as possible, even within the VC portfolio.

A chart presented during the podcast by Chamath Palihapitiya of Social Capital gives a rough idea of correlation between various funds in terms of overlap in investments.

A similar analysis was done by Ashwin Sinha of AdvantEdge Founders for several Indian funds.

Correlation, by itself, of course doesn’t and cannot predict performance; but a fundamental tenet of portfolio management is that lower correlation = lower risk.

«Business»

Apple’s ad business and ATT

On a long enough timeline, every large company eventually becomes an ad network.

From Jack Raines’ blog,

Pre-internet, massive audiences were only reachable through traditional media channels. Post-internet, massive audiences are reachable... everywhere. In scaling billion (and trillion) dollar businesses, the world's biggest tech companies have all built large, engaged audiences.

These large, engaged audiences are extremely valuable.

No one sets out to build an ad business from scratch, but every business, at a certain scale, eventually sells advertisements as a byproduct of its own success. If advertisers are willing to pay thousands, millions, or billions for access to your audience, it's a no-brainer.

Source: Young Money blog, by Jack Raines

…

Notice the one large tech company missing here?

Apple.

For all these years, Apple remained committed to its hardware and software strategy - and shunned ads in line with its “privacy-first” narrative.

For instance, here’s Apple CEO Tim Cook in 2018:

…

However, in April 2021, when Apple launched the App Tracking Transparency (ATT) initiative as part of iOS 14.5, it became quite clear how serious Apple is about advertising.

What’s ATT?

ATT allows consumers to decide whether apps can track them across other applications and websites—a key way for marketers to gather data and then serve up more relevant ads. Typically, the better the ad, the more money it generates.

Before iOS 14.5, 3rd-party sites (for example, Facebook and Google) could access your data through software development kits (SDKs) and application programming interfaces (APIs) embedded in different applications. Put simply, for every website/ app you visited using a Facebook sign-in, Facebook could build your profile by tracking your actions; and advertisers could in turn use these profiles to serve you highly targeted ads. These ads were extremely effective for generating high conversion rates at low costs, making them a primary marketing method for online businesses.

To be fair, even before iOS 14.5, users did have an option to opt out of in-app tracking. But the option was buried quite deep within settings and frankly, who even cares?

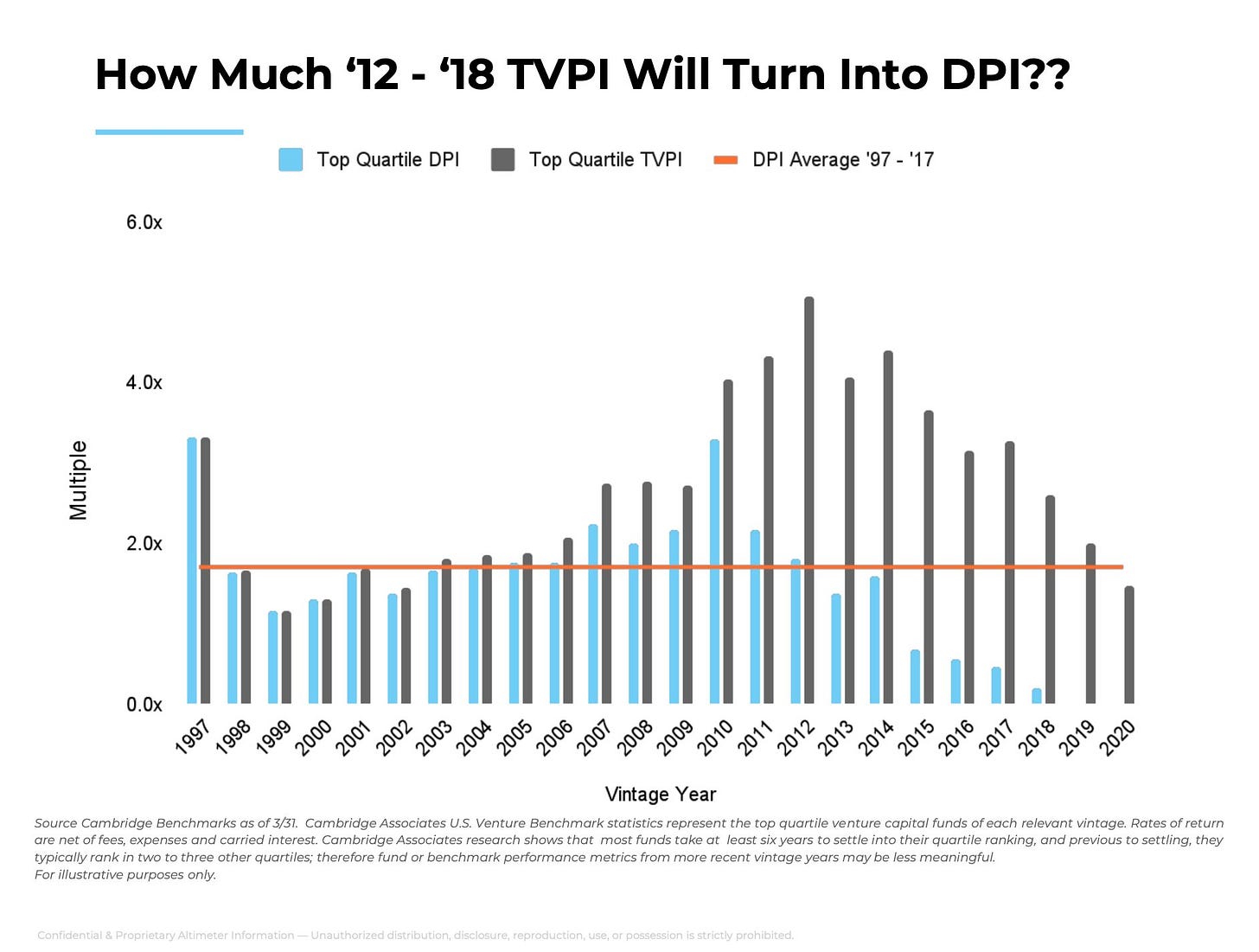

But now, this is what shows up when you sign in.

Now, everyone cares.

As per Flurry Analytics, only ~20% of the users are allowing 3rd party tracking.

…

The obvious consequence was that Facebook’s ads (and similarly ads of other companies like Google, Snap, TikTok etc) became less effective, and hence, less valuable.

Here’s Ben Thomson of Stratechery explaining the phenomenon:

Before ATT, ad measurement, particularly for all-digital transactions like app installs and e-commerce sales, was measured deterministically: this meant that Meta knew with a high degree of certainty which ads led to which results, because it collected that data from within advertisers’ apps and websites (via a Facebook SDK or pixel). This in turn gave advertisers the confidence to spend on advertising not with an eye towards its cost, but rather with an expectation of how much revenue could be generated.

ATT severed that connection between Meta’s ads on one side, and conversions on the other, by labeling the latter as third party data and thus tracking. This not only made the company’s ads less valuable, it also made them more uncertain.

…

Now to the interesting, and perhaps, ironical part.

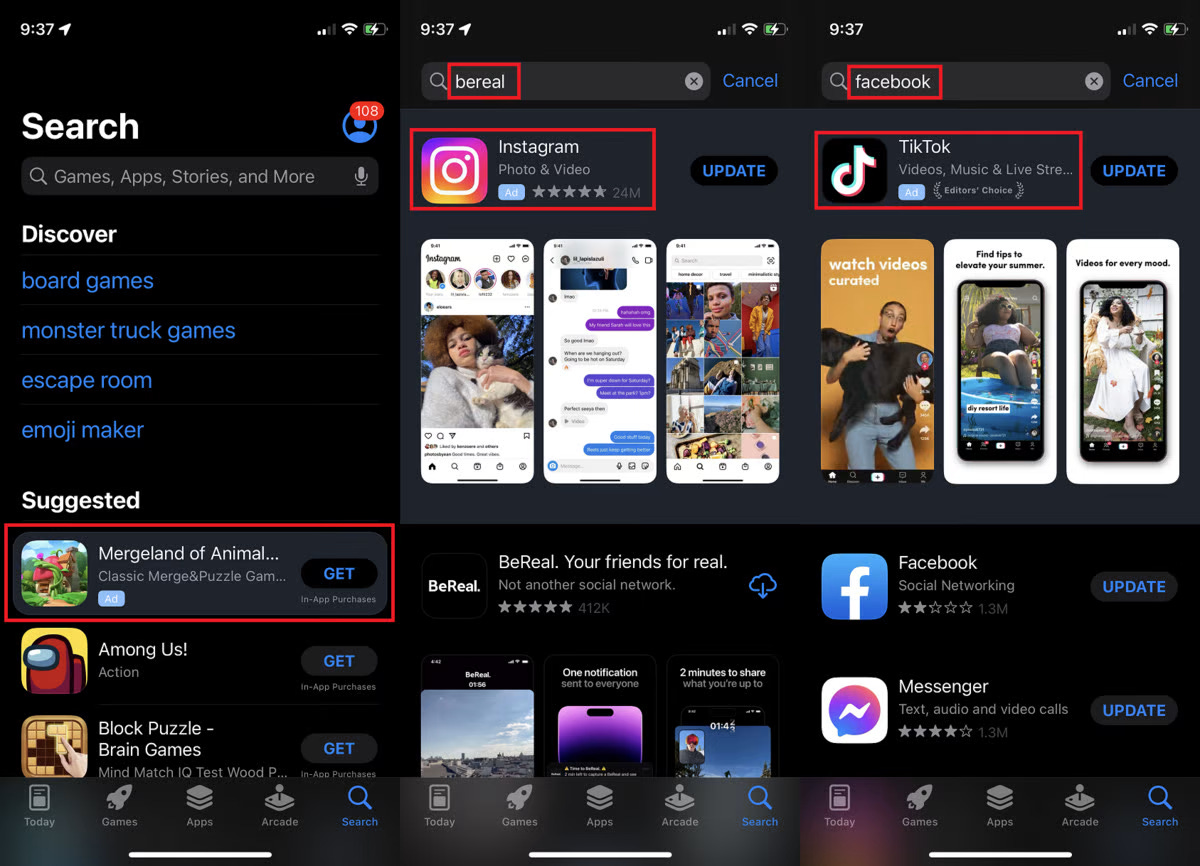

While Apple has managed to upend its competitors’ digital advertising business significantly, it is, over time, planning to significantly scale up its own advertising business.

While the ATT update on iOS 14.5 prevented sharing of information between different parties (i.e. Facebook or Google accessing data from other apps), it still allowed the exchange of information within a single platform.

Apple can STILL track all its users activity across all apps; as long as it happens on its own platform (iOS).

So, while different parties can’t share user data with each other, Apple can gather and share user data with itself - across all its properties like App Store, Apple Maps, Apple TV, Apple News, maybe even iMessage and lock screens.

By owning the hardware hundreds of millions of consumers use to access the internet, Apple ultimately controls the distribution to hundreds of millions of the most valuable consumers in the world.

The impact on other advertising giants is quite there for everyone to see.

An estimate by Lotame Solutions suggests that Facebook, Snap, Twitter and Youtube would together lose around USD 16bn revenue in 2022 due to ATT; with majority of the losses being sustained by Facebook.

While this carnage happens on the side, Apple is making very clear its ambitions in the advertising space. In June 2022, Apple started allowing companies to buy ads on the front page of the App Store. In August, reports emerged that Apple was building a self-service platform for businesses to book ads to be served to customers through Apple products. In October, reports surfaced that Apple was reaching out to potential buyers for ads on Apple TV+.

Here’s an example of ads on Apple News:

Source: Bloomberg

And here’s an example of ads on App Store.

Source - Turner Novak (The Split)

Apple has a LOT of unmonetized real estate available on its platform to expand its ad business. From Apple Maps (imagine a Japanese restaurant paying Apple to be at the top of local listings when a person searches for ‘sushi’) to Apple Books and Apple Podcasts (think of Bloomberg paying Apple to advertise in Apple podcasts since the user had browsed business-related documentaries on Apple TV).

Investment bank Evercore ISI estimates Apple will have a $30 billion ad business by 2026.

That’s about the size of iPad sales in 2021, or a bit under half the company’s services revenue.

…

«Technology»

How India shops online

Bain & Company released the 2022 edition of their popular “How India shops online” report last month.

While the report is worth reading in its entirety, listing below a few insights which I found very interesting.

India’s e-retail market is worth USD 50bn in 2022; and expected to reach around USD 150bn by 2027. That’s 10 percent of all retail dollars being spent online.

The headroom to grow exists across all major categories.

India’s e-retail shopper base scaled to 180–190 million in 2021, with 40–50 million shoppers added in 2021 alone. The majority of these shoppers (about 60%) come from tier-3 or smaller cities. A new generation of digital natives—Gen Z (18–25 years of age)—has started transacting online and will become a critical cohort in the future.

…

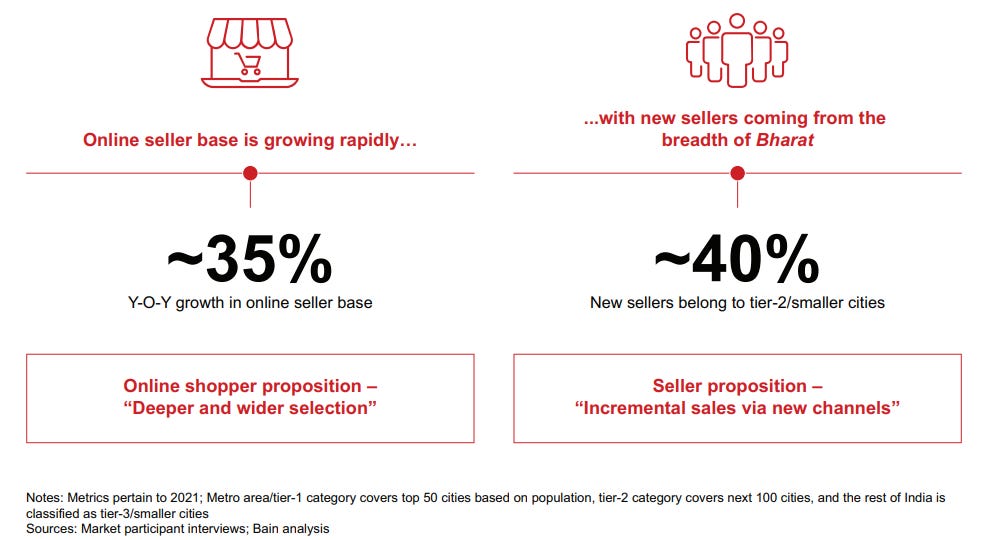

E-retail growth has provided sellers, especially those in small cities, access to a wider shopper base

…

Disparate shopper cohorts emerging (low-middle income, Gen Z, tier-2/smaller cities’ shoppers) with distinct buying behavior from existing e-retail shoppers

…

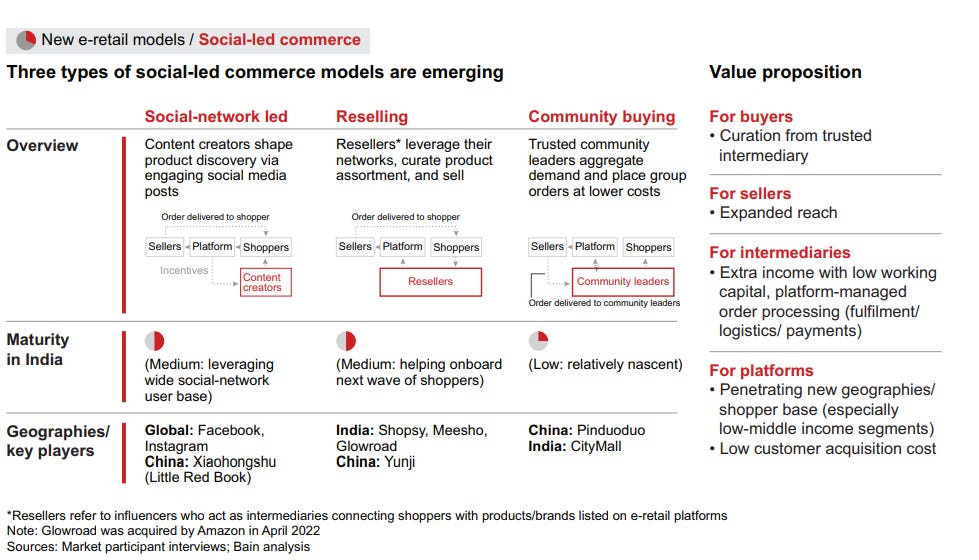

Social commerce (where intermediaries like creators, resellers, community members) use their social circles to drive ecommerce is helping expand the reach of e-retail.

…

Made-for-Bharat e-commerce innovations, such as search via voice and in vernacular languages, are continuing to gain traction

…

Thank you for reading! Please share it with people who you think might find it interesting :)

You can also follow me on Twitter here.

Disclaimer: All views expressed in this blog are mine, and do not represent the views of my employer