[#5] Facebook-Jio deal..How they got here and what lies ahead?

An attempt to understand each company's motivations, and how they can leverage each other's strengths

On April 22, 2020, Facebook and Reliance announced that Facebook will take a 9.99% stake in Jio Platforms Limited for INR 43,574 crores (USD 5.7bn), valuing Jio Platforms at USD 66bn.

Reliance Retail and WhatsApp have also entered into a commercial agreement to accelerate Reliance Retail's new commerce business on ‘Jiomart platform’ using WhatsApp. Jiomart is a platform (an online to offline offering) which helps RIL support small merchants and kirana stores in serving end consumers.

Here’s how the entity structure looks like now:

Source: CLSA, Company documents

…

How they got here

We look at both Facebook and Reliance separately, and see how both of them were striving for similar outcomes, albeit in different ways.

Facebook

To put the deal in context, the Jio investment represents the second-largest investment of Facebook till date (the largest was USD 19bn WhatsApp acquisition in Feb-2014). The investment amount corresponds to a quarter’s worth of free cash flows for the firm.

It is important to note that ~98% of FB’s revenue comes from advertising, a space which is dominated by Google and where there is intense competition from Amazon, Twitter and other players as well.

And here’s a look at how Facebook is faring in terms of revenue and profits:

Note: Quartely data has been plotted on the chart. Source: Stratechery

As can be seen, revenue growth is slowing down, and combined with decreasing margins is leading to slowing profit growth.

Facebook has been trying hard to make a push into commerce. Facebook has always acted as the connecting mechanism between the seller (advertiser on platform) and the buyer (Facebook user). However, the purchase transaction often takes place on some platform outside of Facebook, typically the seller’s website. Facebook wants the transaction to happen on its platform itself, which would make sure that the entire purchase journey (awareness, consideration and transaction) happens on Facebook. What this will do is help ‘close the loop’ and give Facebook stronger control on and more data from the entire purchase journey, making the platform more valuable, while opening new revenue streams.

Here are some of the attempts Facebook has made towards this end:

Reliance

Reliance Retail is already the largest retailer in India (in revenue and number of stores). It has ~11,000 retail stores spread across 6,600 cities and over 25mn sq ft of retail space.

Reliance Retail is now planning to become the largest omni-channel retailer through its hybrid new commerce platform - Jiomart. JioMart follows the online-to-offline (O2O) model. This marketplace model allows products to be sourced from nearby merchants without requiring any native warehouses, allowing on-time hyperlocal delivery, particularly efficient for perishables and fresh food.

Modern retail and e-commerce only make up a small portion of India’s overall retail market. Here’s how the retail market is expected to look like in 2021, as per Deloitte.

And here is the expected penetration of organized retail in different segments as per Technopak Research. Note that penetration in food and grocery segment is the lowest.

Reliance wants to dominate Indian retail by enlisting small retailers that make up the overwhelming majority. It wants to digitise 30mn small merchants and shopkeepers (including kirana stores). To do this, the company is deploying merchant point of sale (M-PoS) machines.

As per The Ken, Retail (especially F&B) and payments are both businesses with thin margins. However, both of them combined together can open up new possibilities. It would enable the company to own the full stack of commerce (similar to what Facebook is trying to accomplish). It will also enable the possibility of delivering several associated services.

The PoS, first and foremost, allows acceptance of digital money by the retailers. It supports cards, UPI and Jio’s own wallet, Jio Money. Second, the PoS is also bundled with Jio’s payments bank account. Third, offering credit to the kirana stores is a huge opportunity. Having the payments data through the PoS would be a huge competitive advantage for Jio as it would enable it to do better underwriting. But not only this, Jio also wants to have access to inventory data. Jio is rolling out a feature which would enable merchants to order inventory from PoS itself. And Reliance Retail already has cash and carry stores and warehouses; this will open up the B2B opportunity which lies quite untapped for now.

Source: The Ken

…

What (possibly) lies ahead

Reliance's partnership with FB aims to create hyperlocal delivery network by connecting kirana shops on JioMart with customers using WhatsApp (having 400mn users).

While we discussed how Reliance has been using its PoS systems to onboard retailers, it is a cumbersome, slow and expensive process. Tying up with WhatsApp would help Reliance Retail extend its B2B distribution framework to millions of additional retailers that already use WhatsApp. This eliminates the cost of acquiring new retailers and the scalability problems of PoS distribution.

JioMart plans to enable nearly 30mn local Kirana shops to digitally transact with every customer in their neighborhood through WhatsApp. It has already piloted in Navi Mumbai, Thane and Kalyan.

This has close parallels with WeChat. WeChat enables grocery chains in China to build mini-apps (a virtual store) within WeChat ecosystem. This model has been highly successful because of two reasons: First, WeChat is integrated with WeChat Pay, to facilitate payments. Hence, the entire purchase value chain happens in the same application. Second, Delivery addresses and other info can be saved within the mini-app, and further instructions can be given through the chat function. This means orders can be completed with just a few taps on WeChat.

With WhatsApp Pay and dedicated WhatsApp Business app, this is very much possible in India.

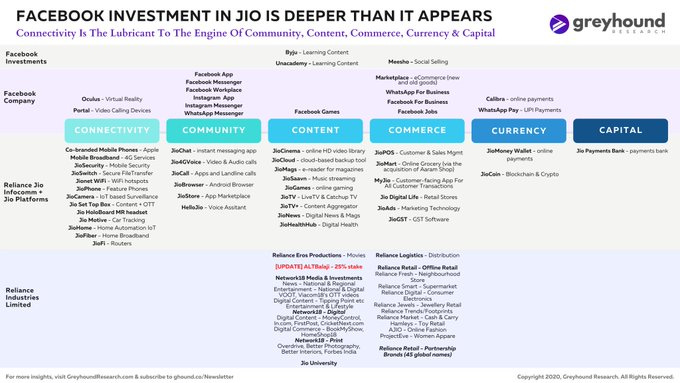

As per Greyhound Research, coming together of Facebook and Jio is a confluence of two major companies with common interests: Connectivity (Broadband, HW), Community (Messaging, Calls), Content (News, Entertainment, Education, Games), Commerce (physical/digital),Currency (wallets) and Capital (Banking).

Source: Greyhound Research

From Facebook’s point of view, it would help facilitating a local-level commerce venture where it has a role in the entire purchase journey. Apart from acting as a monetization tool for WhatsApp, the transaction data could also help support its core advertising business by enabling more focused advertisements. As such, there is no large established e-commerce player in India which is strong in O2O (online to offline) model.

The overall benefits to Reliance (apart from reducing its huge debt burden) would depend on the commercial agreements that are signed between Jio Platform, Reliance Retail and WhatsApp. Questions to be answered include whether all Jio ecosystem apps would be available within WhatsApp, whether the partnership moves beyond F&B into other categories and how the revenue sharing and exclusivity arrangements would work. But for now, it seems clear that JioMart would be able to increase its reach substantially and entrench itself in O2O commerce.

It will also be interesting to see what Amazon, Flipkart and Paytm do next!

…

Some interesting reads

1. Invisible asymptotes (Eugene Wei)

Perhaps the best article I have read this year, yet! Eugene Wei talks about the invisible ceilings that can restrict growth of companies if they continue on the same path / strategy looking at companies like Amazon, Twitter and Facebook and shares his thoughts on how to identify them early on.

2. When tailwinds vanish (John Luttig)

John Luttig shares his thoughts on how the internet tailwinds that propelled meteoric growth in Silicon Valley are now stalling. What next? According to him, zero-sum games between web startups, the operationalization of Silicon Vally, new financial infra, VCs investing in visions over numbers, and R&D beyond the internet.

Thank you for reading! Please share it with people whom you think might find it interesting :)

And if you wish to receive such posts directly in your inbox, please subscribe. No spam, ever!

You can also follow me on Twitter here.