Idea in brief: It is generally assumed that as platforms scale up, the value of their network increases However, in some situations, this assumption does not hold true. We look at the contributing factors in the context of Zomato Gold.

- - - - - - - -

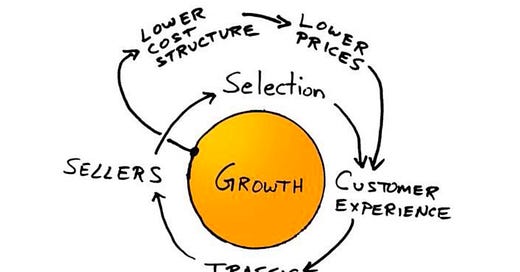

The following image is probably the most commonly used one to describe Amazon’s core philosophy and, to a large extent, its retail business model.

The ‘Amazon Flywheel’ leverages low prices and customer experience to drive users to the platform, and thereby attracting more third-party sellers. That improves the selections of goods, and Amazon further improves its cost structure so it can decrease prices which propels the flywheel.

The flywheel is highly dependent on the concept of Network Effects.

Network effects in brief

Network effects can be well understood as demand-side economies of scale – they occur when a product or service become more valuable to its users as more people use it.

Network Effects, post a certain tipping point, can be auto-catalytic. Generally, there is a strong positive correlation between scale and value generated on account of network effects – bigger network implies more value.

But in some cases, as networks scale, their value might drop. Let’s call this ‘Negative Network effects’.

Negative network effects

To understand this, let’s first consider how value is created on networks.

As per Sangeet Choudary, author of Platform Revolution, there are three sources of value created on networks: Connection, Content and Clout.

Connection: Networks allow users to discover and/or connect with other users. As more users join the network, there is greater value for every individual user.

Content: Users discover and consume content created by other users on the network. As more users come on board, the corpus of content scales, leading to greater value for the user base.

Clout: Some networks have power users, who enjoy influence and clout on the network.

A network or platform may rely on more than one of the above sources to generate value.

Across these three drivers, a network with greater scale provides greater value in the form of more prospective connections for the user, a larger base of potentially relevant content and access to a larger base of potential followers (greater clout) for power users.

As a network scales, one or more of the following situations may crop up, which would lead to a reduction in value of the network. The quality of connections and interactions may go down as more and users join the network, the quality of information shared on the network may diminish with more ‘noise’ than ‘signals’, and the network may (inadvertently) get biased towards the early users, promoting them over users who join later.

Zomato Gold - A possible case study?

In its original version, Zomato Gold was a loyalty program & customer retention tool built atop network effects. However, the following factors show how as it scaled up beyond a point, it became less valuable.

1. Connections

Zomato Gold was never designed to be a ‘mass offering’, but due to significantly low friction in the form of very low joining prices, within three days of its launch towards end of 2017, it garnered 40,000 subscriptions. Within 6 months, that number climbed to 180,000 members. And by 2019, it had a million members. There was a high proportion of ‘discount seekers’, whom restaurants did not seek to attract in the first place. The new users joining the platform lowered the ‘quality of interactions’ (here, measured as average billing value and dining-out frequency) and hence, as the platform scaled beyond a point, the value derived by restaurant partners did not increase in the same proportion, and in some cases, declined.

From a consumer standpoint too, an increasing number of members made the value proposition less attractive. Generally, most individuals dine out with a common set of people, be it family members, friends or colleagues. If some of those people already had Zomato Gold subscriptions, it didn’t make much sense for the person under consideration to have it as well.

Side question: How should a company promote such a product knowing that the marginal utility per consumer (or probably the willingness to pay) will keep going down with each sale? While the market may be big enough to begin with, the saturation point will come soon enough.

2. Content

Here, the content would be more on the lines of transaction data generated. Zomato did not share the user data with restaurant partners, limiting their ability to curate and personalize their offerings. This had a dual impact – the restaurants could not influence choices of potential customers, and the program turned out to be more of a ‘discovery and discount’ platform than a loyalty program.

How to prevent negative network effects from setting in?

Building in adequate friction to access and use the network (whether in the form of fees or usage restrictions) may keep the quality of interactions high, and help maintain a high signal to noise ratio.

A proper data-sharing mechanism needs to be put in place. The data needs to be used to improve customer experience through curation and personalization. More importantly, it should generate value for all sides / partners in the network. Cue can be taken from successful loyalty programs built by airlines and hotels the world over.

Finally, new entrants should be allowed to build influence while bias towards earlier entrants should be minimized. A simple example - restricting ratings & reviews to stay on for a limited period (say 3 months) would help new sellers develop a meaningful presence on Zomato, as the benefit enjoyed by cumulative ratings by established restaurants would be reduced to an extent.

Some interesting reads

Luckin Coffee grew from 0 to 4500 stores in 2 years in China (while Starbucks took 20 years for 4,000 stores), opening a new store every 3-4 hours at one point. Well, turns out its a massive fraud!! ¯\_(ツ)_/¯. The COO and others fabricated transactions to boost revenue by around USD 300mn in 2019.

An anonymous report had claimed the same in January 2020, which the company denied then. You can read it in full here.

Interesting thing to note: the authors hired 1,500 people to record 11,000+ hours of store traffic data!! Talk about taking scuttlebutt seriously.

‘Force Majeure’, a French term, means ‘a greater force’. In legal parlance, it refers to a clause that absolves parties from financial liability for not fulfilling a contractual obligation due to an unforeseeable event. Expect a lot of companies to invoke this clause in their contracts in the months to come in light of the Covid situation. This tweet thread provides a very simple-to-understand explanation and also the sector-wise implications.

Thank you for reading! Please share it with people whom you think might find it interesting :)

And if you wish to receive such posts directly in your inbox, please subscribe. No spam, ever!