[#3] Why market size estimates are often wrong

Two common errors in assessing Total Addressable Market

“Founders think of startups as ideas, but investors think of them as markets. If there are x number of customers who’d pay an average of $y per year for what you’re making, then the total addressable market, or TAM, of your company is $xy. Investors don’t expect you to collect all that money, but it’s an upper bound on how big you can get.”

- Paul Graham, founder of Y-Combinator

Total Addressable Market (TAM), also sometimes referred to as total available market, is the overall revenue that a product / company can generate, assuming 100% market share is achieved.

TAM is a very important metric while assessing any business / investment opportunity. It helps not just in assessing revenue opportunity, but also serves as a cornerstone of setting up a product roadmap and execution plan, while being cognizant of competition.

However, TAM analyses often miss out certain crucial aspects. Below, we have a look at the two most common & critical errors – the first leads to under-estimation of potential and the second, over-estimation.

Error 1: Focusing only on existing markets

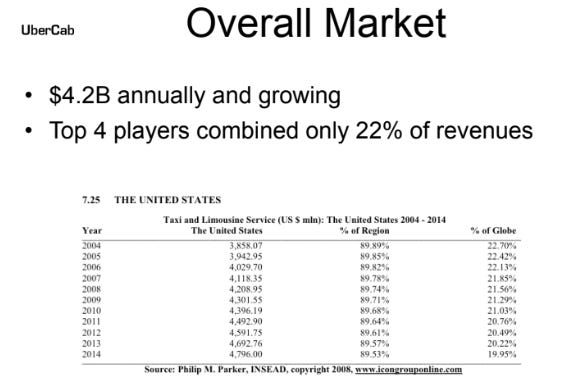

Have a look at this TAM slide that Uber used in its first pitch deck to raise money from investors.

The basis for determining TAM was looking at the US taxi and limousine service market. Obviously, we now know that Uber has far surpassed these estimates, creating new markets on its own in the process.

Estimating TAM can be very tricky when technology and / or customers are new. The number of ultimate adopters as well as the rate of adoption can be tough to estimate in such cases. TAM, which measures the size of the potential market today, can often under-estimate the potential market size by thinking that the future will look quite like the past. However, a new offering can unlock new markets and get into fold a new set of customers.

Bill Gurley, partner at Benchmark Capital and an early investor in Uber, explains this very well (1):

…..(that) the arrival of a product or service like Uber will have zero impact on the overall market size of the car-for-hire transportation market... is a flawed assumption. When you materially improve an offering, and create new features, functions, experiences, price points, and even enable new use cases, you can materially expand the market in the process. The past can be a poor guide for the future if the future offering is materially different than the past.

Uber’s potential market is far different from the previous car-for-hire market, precisely because the numerous improvements with respect to the traditional model (like pick-up times, coverage density, payment mechanisms, trust & safety) lead to a greatly enhanced total available market.

There is of-course a need for caution – this should not become an excuse to estimate overly optimistic TAM figures. However, as entrepreneurs and investors, it is definitely useful to imagine how the future might be materially different than the past, and how new markets may get unlocked.

Error 2: Ignoring economic realities

Let’s take the example of the market potential for India internet-based companies. There is no doubt that the market is huge – India has over close to 600 million Internet users and 300 million smartphone users (seeing a sharp spurt in the past few years due to declining price of both data and smartphones).

However, is this one homogeneous market? The answer obviously is No. Being a Google user (which is a free service) does not mean one would be an e-commerce user as well (which is a paid service). Yet, while estimating TAM, companies often use the number of Internet users as the starting figure to determine their revenue potential. They are ignoring the ability and willingness of customers to pay for these products / services.

Here’s what Haresh Chawala, partner at True North fund, says about this (2):

If you stacked up a 100 Indians, here’s how our income distribution looks:

1 Indian earns 30% of the total and makes over Rs 1.5 lakh a month

14 Indians earn 30% of the total and make around Rs 20,000 a month each

The next 30 Indians earn 30% of the total and make Rs 8,000 per month each

The poorest 55 Indians earn 10% of the total and make only Rs 1,500 per month each

Simply put, we live in three countries:

India One: Club the top 2-tiers above and you find that the top 15% of Indians, i.e. about 150-180 million, earning an average of Rs 30,000 per month, are the ones who have money left over after buying necessities. These 15% of Indians control over half the spending power of the economy and almost its entire discretionary spending.

India Two: This is the middle 30% or 400-odd million Indians, earning an average of Rs 7,000 a month. This would be a country about three times the size of Bangladesh with a similar level of purchasing power.

India Three: These are the forgotten 650 million who subsist and don’t have the money to buy two square meals. Their incomes rival that of sub-Saharan Africa. ..They live on the periphery of our economy and for all practical purposes don’t participate in it.

Net, net we are three countries. One with the size and wealth of a developed nation, another of 400 million people like a developing nation, and a third large continent of 650 million people whose lives rival that of a poor nation.

The failure to distinguish between “internet users” (India Two) and “internet consumers” (India One) has messed up every estimate of the market. This destroyed TAM calculations that have driven most VC funding and valuations.

This partly explains why bulk of the e-commerce growth in past couple of years has come from the same set of customers spending more, and not as much from new customers coming into the fold. While we ofcourse need to be cognizant of the fact that the future may / would not be the same as the past (as we discussed earlier), it is also critically important to consider how long would it take for the shift to happen and whether a particular shift is even possible looking at economic realities.

……

Assessing TAM is tough. This metric is also very prone to misuse (or rather mis-execution), often calculated either too aggressively or conservatively. However, keeping such common errors in mind would help both entrepreneurs and investors have a better sense of business potential of a product / service.

Some interesting reads

1. Preserving optionality (Farnam Street)

How do we prepare for a world that often changes drastically and rapidly? We can preserve our optionality…Instead of focusing on becoming great at one thing, there is another, counterintuitive strategy that will get us further: preserving optionality. The more options we have, the better suited we are to deal with unpredictability and uncertainty. We can stay calm when others panic because we have choices.

2. Indian PE outlook (Praxis & IVCA)

A report by Praxis and IVCA discussing the impact of current economic shock on the business environment, impact on different sectors, and expected deal opportunities in the short to medium term.

References:

(2) http://www.foundingfuel.com/article/how-indias-digital-economy-can-rediscover-its-mojo/

Thank you for reading! Please share it with people whom you think might find it interesting :)

And if you wish to receive such posts directly in your inbox, please subscribe. No spam, ever!