[#7] Why startup valuation numbers may be misleading

An attempt to show how reported valuation numbers do not give the full picture

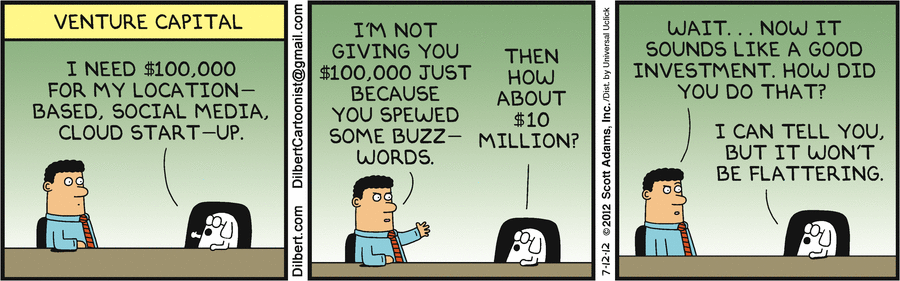

One of the commonly used metrics for determining ‘success’ of startups is their valuation – each new funding round is accompanied by media reports on how the valuation of the startup has increased / decreased.

However, not much attention is paid to the manner of arriving at these valuations and whether they give an accurate picture. In this post, I attempt to explain how the headline valuation numbers almost never give the full picture, and hence should be taken with a (big) pinch of salt.

…

How are valuation numbers derived?

“___ startup raises USD__ at a valuation of USD ___”

Let’s consider a simple example.

Company A has raised three rounds of funding till date. The third round of funding (called Series C) was USD 100 million in exchange for 10% stake in the company.

Here is the summary of the funds raised by this company till date.

This would give the company a headline valuation of USD 1 billion (USD 100 million divided by 10% stake). This is known as the ‘post-money valuation’ of the company.

Listed companies generally have a single class of common equity shares. Venture Capital-backed companies, on the other hand, typically create a new class of shares (with different rights, protections and restrictions) every time they raise money. In the case of Company A, different classes of shares may have been issued in each of the 3 rounds of fund raising.

Now, generally, Value of whole = Sum of the individual parts

When we say that the value of Company A is USD 1 billion, we are implying that securities issued even during Series A and B rounds are now worth the same per-share value as the Series C securities. But as we will see below, the various share classes are not created equal. So is Company A really worth USD 1 billion?

…

Heads I win, Tails I don’t lose much

Often, the investment terms of VC deals involve certain clauses, which while having a significant bearing on the investors’ risk and returns, are not captured in the reported valuation figures. Probably the most important ones are Liquidation Preference and Anti-dilution provisions.

Liquidation preferences

Liquidation Preference impacts how the proceeds are shared in case of a liquidity event (for example, sale of the company or majority of its assets). It is a provision meant to serve as protection for investors if the company sells for a value lower than what was initially expected.

Put simply, if a VC fund puts in USD 100 million in Company A for a 10% stake along with a 1x liquidity preference, it means that when the company is sold, USD 100 million will be paid back to the investor before paying anyone else. Similarly, in case there is a 2x liquidity preference, USD 200 million will be paid back to the investor. Often, the liquidity preferences are structured as ‘participating rights’. In such a case, after paying back the amount above, the investor would receive additional ‘participation’ in the remaining proceeds in proportion to their ownership.

So, if company A sells for less than USD 100 million, the investor would keep the entire sales proceeds. The founders and other shareholders (say, employees who hold stock options) would get nothing.

If Company A sells for USD 150 million, first of all, the investor having 1x liquidation preference would be paid USD 100 million. 10% the remaining USD 50 million (that is, USD 5 million) would also be paid to the investor. The rest would go to the founders and other shareholders. So even if the founders own a majority stake, they would end up getting paid significantly less than the investor

Such preferential rights can also be stacked. So if the investors in Series A and Series B had also asked for a liquidation preference, the rights could be stacked in a manner wherein the Series C investor gets his money first, then the Series B investor and then the Series A investor. Only the amount remaining after paying them off would be available for distribution amongst the founders and other shareholders.

In such a scenario, it is easy to observe that as long as Company A sells for atleast USD 140 million (which is the total amount of capital invested in the three rounds), no investor would suffer any loss. No loss, despite the fact that the company was being valued at USD 1 billion in the most recent fund-raise.

So, did the investors invest at a USD 1 billion valuation? Not really, because they also effectively have a put option which protects them even if the value of the company falls to USD 140 million (that is, by 86%).

Anti-dilution provisions

VC investors are generally issued preference shares, and not common equity shares. These preference shares are convertible into common equity shares at certain milestones, which are pre-decided.

The anti-dilution provision is used to protect investors in the event a company raises funds at a lower valuation then in previous financing rounds (known as a ‘down round’).

Let’s say, Company A goes on to raise the fourth round of funding a year later (Series D), however, it does so at a valuation lower than USD 1 billion. While each funding round typically results in the dilution of ownership percentages for existing investors, the need to sell a higher number of shares to meet financing requirements in a down round increases the dilutive effect.

In order to safeguard his interests, the Series C investor, at the time of investment, may ask for anti-dilution rights. The way this works is as follows: the number of shares of common equity shares each share of preferred stock held by Series C investor is convertible into will be increased (for example, instead of being convertible into 1 share of common stock, the preferred share may be adjusted so that each share is convertible into 1.1, 1.2 or some other number of shares of common equity shares).

In simpler terms, this can be thought of as additional shares to be issued to the Series C investor (for no additional consideration) to reduce the dilution impact and hence his risk. These additional shares being issued would in turn lead to shareholding of founders and other shareholders falling even further.

…

Why all this matters

Some venture capital firms value their portfolio companies by taking the post-money valuation of the most recent fund-raising round and assigning that value to their ownership in the company. For example, Series A and Series B investors in Company A would also mark up their investments to reflect the overall valuation of USD 1 billion post the Series C fund-raise. In a scenario where certain investors enjoy liquidation preference or anti-dilution rights, this could dramatically over-state the fund’s unrealized gains and under-state the risks

Not just VC funds, but even retail mutual funds like Fidelity and T Rowe Price invest in startups. The rise of third-party equity marketplaces has allowed even small investors to invest directly in startups. By determining the valuation of their holdings based on the post-money valuation of the company, they could be significantly under-stating the risks they face in case the startup faces a down round or sells for a lower valuation than expected

Employees in startups often receive a significant part of their compensation in the form of stock options. Most employees use the post-money valuation while valuing their stock compensation, which could lead them to over-estimate their compensation package or wealth

…

Determining a startup’s valuation is tough. Complicated financial structures and special rights & protections to certain investors further complicate the process. With traditional methods like discounted cash flows and simple price multiples often not being feasible, valuation is generally based on the latest fund-raise’s negotiated price, applied to all outstanding shares. But the real value of a startup can be determined only after studying the shareholder agreements in detail, something that is almost impossible considering these are private enterprises.

It’s time we stop taking the reported valuation numbers at face value.

…

Some interesting reads

1. ReadList (Ankit Kumar, Palak Zatakia and Abhay Jani)

Thoughtfully curated reading lists for interesting topics / companies like Product Management, Venture Capital, Facebook, Amazon and many more. Reduced time for searching, more time for learning!

2. Can Neobanks succeed in India (Vedica Kant)

Vedica has written an excellent post on neobanks - covering how the business works in US & EU and how it might look like in India

Thank you for reading! Please share it with people whom you think might find it interesting :)

And if you wish to receive such posts directly in your inbox, please subscribe. No spam, ever!

You can also follow me on Twitter here.

Simple, but not simpler! Really admire your writings