[#12] Real Options

Taking a leaf out of venture investing for public markets investing

Hey! Welcome to Marginal Futility. This blog is my attempt to summarize and share some interesting things I come across, especially related to business, finance and tech. I have previously written about the power law in venture capital, business lessons from Amazon and common errors in estimating market size. You can find the full archive here.

You can subscribe below if you wish to receive updates directly in your mailbox. No spam, ever! :)

(Disclaimer: All views expressed in this blog are mine; and do not, in any way, represent the views of my employer.)

On to today’s article…

I came across an interesting tweet a few days back.

Conventionally, the most common fundamental valuation tool used used by public market analysts is the Discounted Cash Flow (DCF) model. In this method, cash flows projected basis the modeling of discrete financial variables are discounted at the appropriate rate to arrive at the present value of the business.

In order for a DCF to be effective, we need to have estimates for the 1) payoff of the investments being made by the company; and 2) timings of those payoffs.

In the real world, however, there are several investments where the quantum and timings of payoffs is uncertain; and often not even amenable to estimation early on. This is especially true for technology companies; which function on a series of ‘embedded options’ with highly unknown outcomes.

‘Real options thinking’ can help in such cases.

…

What are Real Options?

A financial option gives the holder the right, but not the obligation, to purchase or sell a financial asset at a given price.

Extending this logic to ‘real assets’, a real option gives the company the right, but not obligation, to make a value-generating investment.

ShawSpring Partners defines it as follows:

Optionality is the expected value of a current or future investment that is unknowable or difficult for the market to discern.

To be considered an “option” there needs to be some mystery to the consideration, or it would likely already be incorporated in the business’ valuation. This is why Optionality needs to be “unknowable or difficult for the market to discern.

…

Types of Optionality

As per Michael Mauboussin, real options can be classified into three main groups: Invest/grow options, defer/learn options, and disinvest/shrink options.

The first category involves options to scaling up investments, switching up investments basis the shift in underlying conditions and scoping up investments by leveraging an investment made in one industry into another. The second category is the ability to wait before making investments, allowing for reduction in uncertainty. The last category involves the option to scaling, switching and scoping down investments.

The first category is the most interesting, and most relevant, while analyzing high growth companies.

…

When is Real Options analysis most relevant?

From the paper ‘Get Real’,

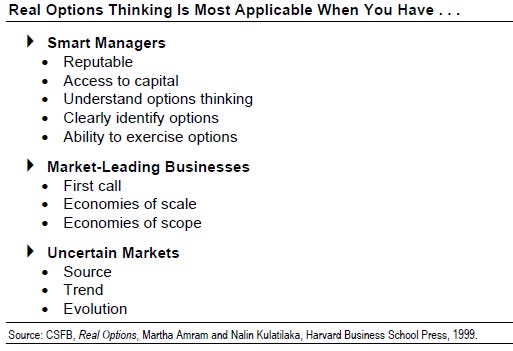

Real options are particularly important for businesses with a few key characteristics:

The first is smart and reputable management with access to capital. Managers must understand options, identify and create them, and appropriately exercise them. This contrasts with business leaders focused on maintaining the status quo or maximizing near-term accounting earnings

Businesses that are market leaders are also attractive, as they often have the best information flow and richest opportunities—often linked to economies of scale and scope.

Finally, real options are most applicable precisely where change is most evident

…

Limitations of DCF

From Hayden Capital’s Nov’20 investor letter:

DCFs are great at valuing businesses in the optimization phase – they already have a product and new product launches are unlikely to materially affect the trajectory of the company. As such, most of the future value creation comes from optimizing the existing product / service (growing number of customers, raising prices on existing customers, streamlining operations to cut costs and improve margins, etc.). These are linear and gradual changes…

By contrast, knowledge-based industries such as technology derive a significant amount of value in the optionality – creating a new product or service using existing internal capabilities, that if successful, will significantly change the trajectory of the company (for example, Apple launching the iPhone created shareholder value multiples the size of Apple’s previous state). And the earlier-stage the company, the larger the embedded real options value drives the valuation of a company, as opposed to the value of current business in its existing form today.

DCFs typically use a linear growth methodology while evaluating future growth prospects of a company. It is impossible to distill all variables into a growth rate, and often the highly uncertain aspects get left out. Often for good reason though - there is little merit in over-complicating a valuation model.

But this thinking can significantly under-value companies which have a lot of embedded optionality.

Most valuation estimates may go a step further and give the ‘base, bull and bear case’ valuations, but may not capture the optionality upside.

Source: ShawSpring Partners

Real options analysis complements the standard DCF approach and adds a meaningful amount of flexibility.

…

Some examples of companies with embedded options:

Uber

In 2014, Mr. Aswath Damodaran (Professor at NYU) wrote a post on Uber’s valuation, arguing that Uber’s business wasn’t worth its private market valuation of USD 17 billion. In response, Bill Gurley (Partner at Benchmark Capital and an early investor in Uber) wrote a post on how Mr. Damodaran’s analysis did not take into account the embedded optionalities in Uber’s business like the ability to expand existing markets, developing new use cases and eventually acting as an alternative to car ownership.

Reliance Jio

Valuing Jio as a telecom player may seem like a big error now, but that’s how it was being valued a few years back. Since then, Jio has started effectively leveraging its ecosystem to enter into various business lines.

Source: Counterpoint Research

…

Summing up

DCF is inherently complex and sensitive to assumptions. Adding real options analysis to it definitely adds in another layer of ‘uncertainty’ - how much can one rely on these uncertain payoffs and how much value can be ascribed to such ‘long shots’.

It would definitely be wrong to get overly enthusiastic about real options and treat them as near certainties, but it would also be a mistake to exclude them from analysis.

Thank you for reading! Please share it with people who you think might find it interesting :)

You can also follow me on Twitter here.

(Disclaimer: All views expressed in this blog are mine; and do not, in any way, represent the views of my employer.)

In Indian listed space, I see this real option value in Indiamart. Would love to hear your comments on this

Would've loved to read more about how one would go about value these optionalities quantitively. Great post, nevertheless!