[#17] On 'Goal-seeking' Zomato's valuation, Facebook's scale and hedge funds' ingenuity

Value lies in the eyes of the beholder

Hey! Welcome to Marginal Futility. This blog is my attempt to summarize and share some interesting things I come across, especially related to business, finance and tech. You can find my previous posts here.

You can subscribe below if you wish to receive updates directly in your mailbox. No spam, ever! :) You can also follow me on Twitter here.

(Disclaimer: All views expressed in this blog are mine; and do not, in any way, represent the views of my employer.)

On to today’s post…

<<Finance>>

Goal-seeking Zomato’s valuation

Zomato got listed recently, and as expected, the internet was filled with opinions on its valuation. The bulls and bears both make pretty strong cases; but one of the most reasoned arguments came from Prof. Aswath Damodaran. Recognizing that the estimates of key variables would differ wildly across his audience (yes they do, his valuation is ~70% lower than current market price 😅), he uploaded a DIY valuation model - users can tweak the model inputs and arrive at the valuation by themselves.

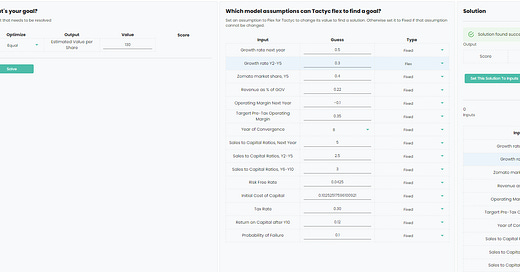

The folks at Tactyc.io have converted it into an interactive model (check it out here) and were kind enough to allow me access to their premium feature - Solver (a more advanced version of the Scenario Analysis feature in Excel).

While I don’t understand the food delivery market very well and hence arriving at key assumptions by myself in the DIY model would be an exercise in futility , I am quite interested in understanding what expectations are being built in the current price.

Before that, a quick look at the inputs and reasoning given by Prof Damodaran in his model, leading to a target price of INR 41 (CMP: INR 130).

(Note: There are a few other variables like reinvestment rates, cost of capital etc., however, the model is most sensitive to the ones above)

Now, for the fun part - seeing what the market thinks!

First off, I want to see the market growth rates being factored in by the CMP.

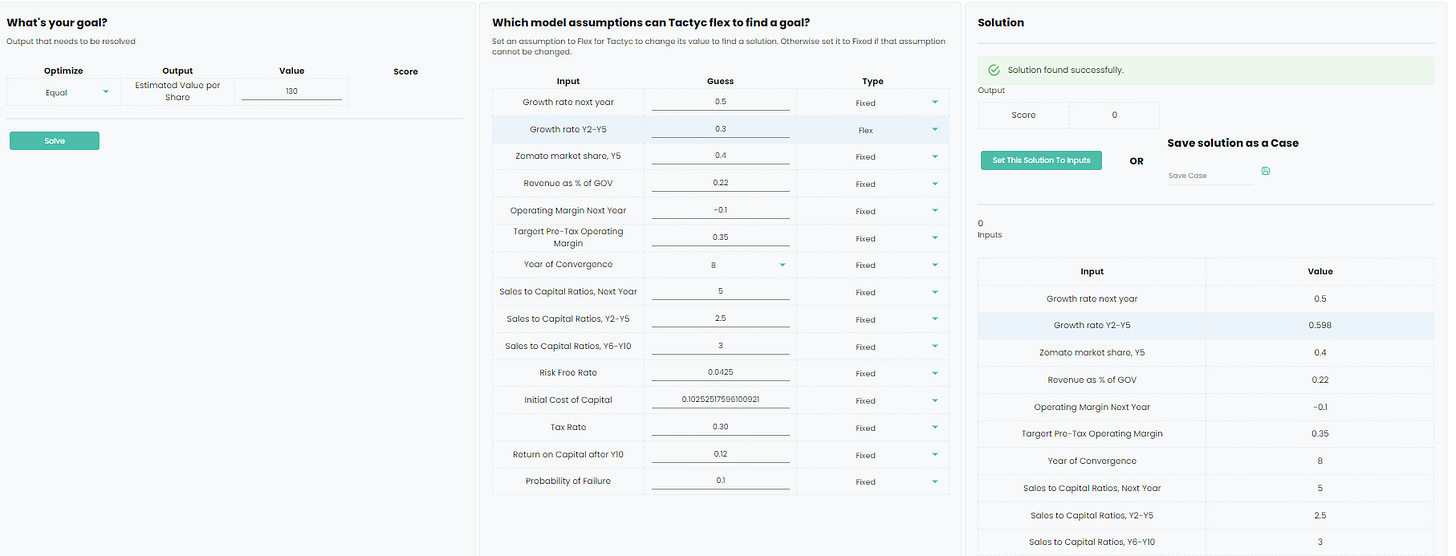

So, the market is factoring in a 60% CAGR over Years 2-5. Note that considering our convergence towards a terminal growth rate of c.4%, this implies a 27% CAGR over Years 6-10.

Its difficult to assess the power of compounding looking at just percentages.

What the above rates imply is a 30x growth in market size over next 10 years!

Now, lets look at another variable - Zomato’s market share. We go back to the growth estimates being factored in the original model.

This leads to a mathematical impossibility - a market share of 143%.

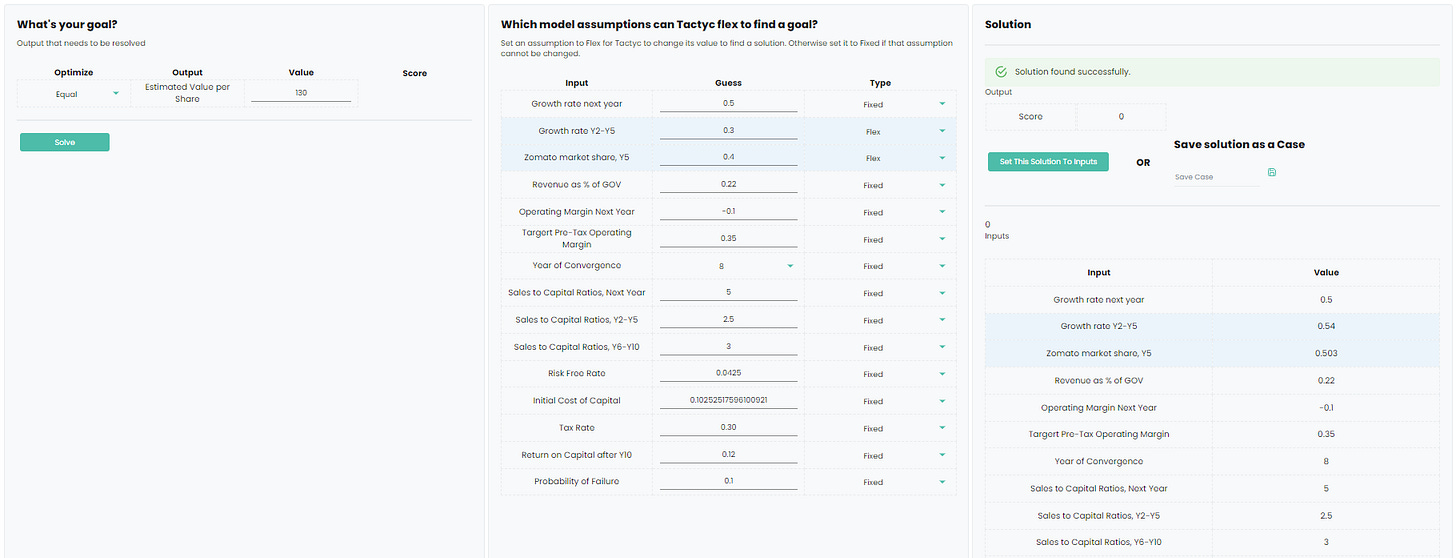

Finally, let’s try one more scenario - where we keep both growth rate and market share as ‘flexible inputs’.

So, the market is factoring in a 54% CAGR over Years 2-5 (and 24% CAGR over Years

6-10) implying a 25x growth in market size over 10 years, with Zomato capturing and maintaining a 50% market share.

…

I think the biggest point of contention would be the the market size that Zomato is targeting over time - is it fair to assume that they would only be targeting the Indian food delivery market? They could, over time, target other markets within India (from grocery delivery to becoming a lender to restaurant partners) which would materially increase the target market size. They could also target foreign markets in some or all of these verticals, again resulting in an increased Total Addressable Market.

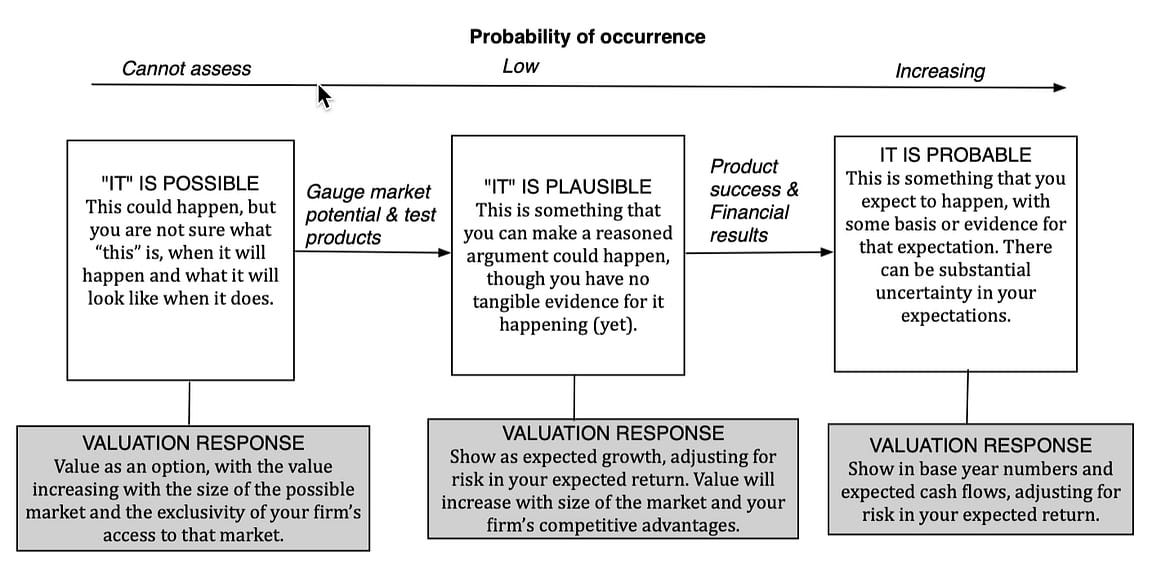

I have written about ‘Real Options’ earlier. Real Options refer to the right, but not an obligation, to a company to make value generating investments. In brief, this was the message - DCF may not capture several investments where the quantum and timing of payoffs is uncertain, this is especially true for technology companies which function on a series of ‘embedded options’ with highly unknown outcomes.

In essence, our estimations for Zomato, or any other company, can lie across a spectrum - Probable, plausible and possible.

It is up to the investor to assess how far on the spectrum is he/she willing to pay up for outcomes, today.

<<Business>>

Facebook’s (still) under-appreciated scale

Facebook finally crossed USD 1 trillion in market cap this June.

I recently read a brilliant article written by Packy McCormick on Facebook - his key message was that Facebook’s scale and potential is still under-appreciated.

Noting below a few things I found very interesting:

On Facebook’s scale

The main Facebook product had 1.8 billion Daily Active Users (DAUs) and 2.7 billion Monthly Active Users in Q3 2020, while the “family” of products (Facebook, Messenger, Instagram and WhatsApp) saw 2.5 billion Daily Active People (DAPs) and 3.2 billion Monthly Active People (MAPs).

Note that Facebook does not operate in China - if you exclude China’s population, Facebook reaches over half of the world’s population every month.

…

On Facebook’s business model

This one’s easy to answer - they run ads. Watch this clip to hear Mark say it 😂

What’s not easy is replicating what Facebook is able to do.

Contrary to popular media narratives, Facebook does not ‘sell’ user information. Using the trove of data that it is able to collect across its properties, Facebook finds users that “look” like - or are similar to - an advertiser’s most valuable users.

Put simply, as an advertiser - If you upload your list of customers, you can ask FB to find more people that are similar to them. FB is able to do this much better than anyone else because it has so much behavioral and demographic data for close to half of the world’s population.

Unlike Google, which is intent-based advertising (you search for shoes and you see shoe advertisements), Facebook is interest-based advertising (you ‘liked’ a post about the track events at Olympics and you see shoe advertisements). Google will show you things you wanted, Facebook will show you things you didn’t even know you wanted.

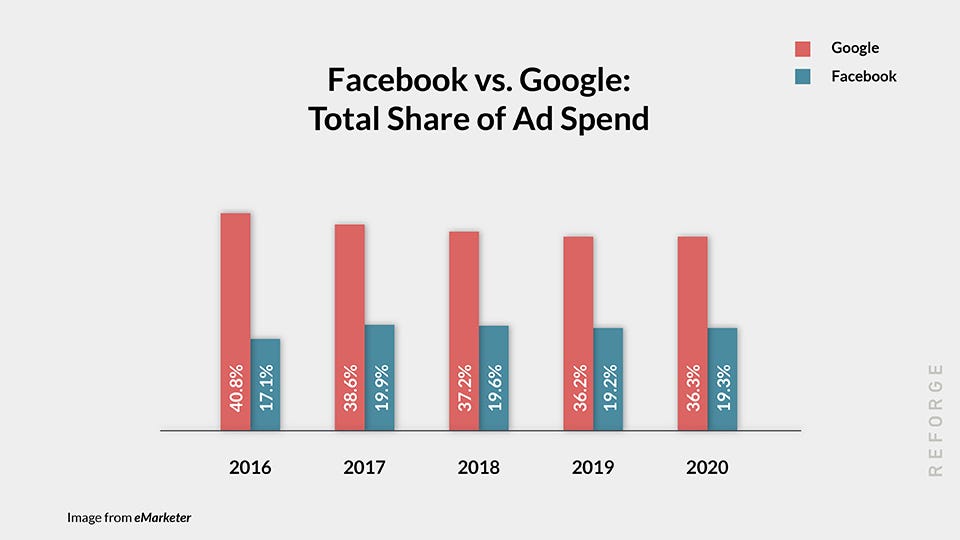

And it is working well for them - they are gaining market share at the expense of Google.

On Facebook’s backward integration:

Facebook is backward integrating from simply being an advertising platform into building the tools to facilitate customer communication and commerce in-app. Just like Tencent built tools for businesses in WeChat after seeing businesses communicating with customers in the app, Facebook saw businesses in Thailand use profiles on WhatsApp, Facebook, and Messenger as their homepages and leaned in by adding features. They built catalogs, then a Marketplace Tab, then power tools. Now, Facebook powers roughly 1% of Thailand’s GDP (~$5 billion in GMV), and Facebook is rolling out the tools that it built there in the US and around the globe.

Facebook has always acted as the connecting mechanism between the seller (advertiser on platform) and the buyer (Facebook user). However, the purchase transaction often takes place on some platform outside of Facebook, typically the seller’s website. Facebook wants the transaction to happen on its platform itself, which would make sure that the entire purchase journey (awareness, consideration and transaction) happens on Facebook. What this will do is help ‘close the loop’ and give Facebook stronger control on and more data from the entire purchase journey, making the platform more valuable, while opening new revenue streams.

…

On Facebook’s next platform

Facebook had acquired Oculus, a maker of VR headsets, for USD 2.3bn in 2014. It also acquired CTRL-labs, a brain-computing startup, for a consideration between USD 0.5-1bn in 2019.

In August last year, Facebook rolled Oculus, CTRL-labs, Portal, and Snap Lens Studio lookalike Spark AR into Facebook Reality Labs. This division is responsible for Facebook’s efforts in VR, AR, and the spatial computing operating system.

Mark has laid down a grand plan to transform Facebook into a metaverse company. What’s the metaverse? Coined in Snow Crash, Neal Stephenson’s 1992 sci-fi novel, the term ‘Metaverse’ refers to a convergence of physical, augmented, and virtual reality in a shared online space.

Facebook’s ambitions in virtual this space are huge - while contributing less than 3% of its current revenues, nearly 10,000 people, that is 20% of Facebook’s total workforce, are working on its VR/AR efforts.

If Facebook becomes the default platform for VR, AR, or both, it will hold the position that Apple and Google hold in mobile today.

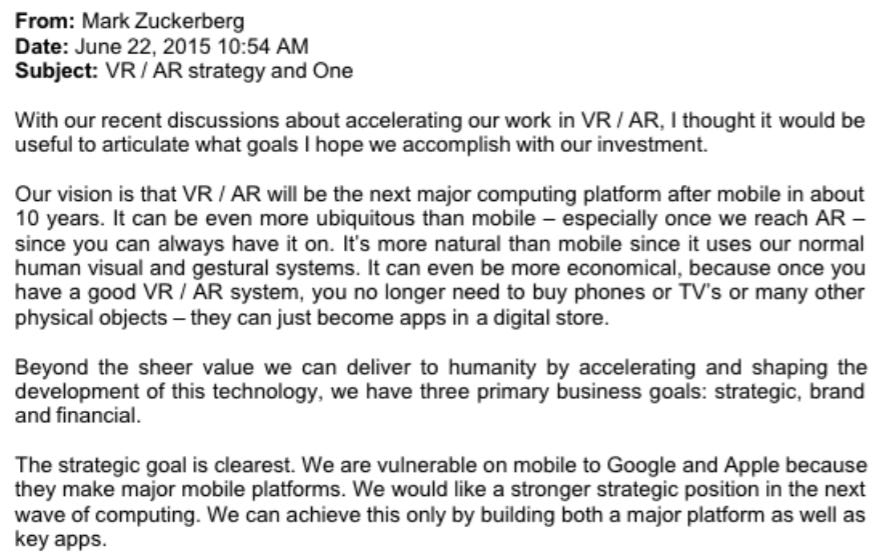

Mark Zuckerberg sent a 2,500-word email to a few senior executives in 2015 laying out his big plan for Facebook to dominate virtual-reality. His email was regarding Facebook's potential acquisition of gaming-engine development startup Unity - a deal which never came off.

Here’s how he describes his vision:

You can read the full email here.

...

From a yet-unmonetized asset in the form of Whatsapp, to building a huge backward integration engine to effectively ‘tax’ ecommerce and a massive push towards what could possibly be the next computing platform post PCs and mobiles - Facebook sure seems to have a long runway.

<<Technology>>

Obscure data that hedge funds use

I came across an interesting report by Alternative Investment Management Association (AIMA) on the increasing usage of alternative data by investment firms to gain an ‘edge’. You can read the full report here.

What’s alternative data? An overly simplistic definition - Everything that doesn’t fall within the realm of traditional financial and economic data.

A good example is what WSJ reported back in 2016.

Here’s an excerpt:

A company called Planet Labs Inc. has launched a small constellation of what it calls “cubesats” that can deliver much more frequent imagery of economically sensitive spots than traditional satellites. Those spots include retailers’ parking lots, oil-storage tanks or farmland.

The company, founded by three former NASA scientists, has now signed an agreement to supply data to Orbital Insight Inc., which mines satellite imagery for trading tips for hedge funds.

Imagine predicting how Walmart will do next quarter by analyzing how full or empty its parking lots are across the world. 🙃 That’s alternative data.

Here are a few more types of alternative data: (Source: Quinlan & Associates report)

The number of alternative-data providers is more than 20 times larger now than it was 30 years ago — with more than 400 currently active providers, compared to only 20 in 1990. As per Eagle Alpha, 78% of US hedge funds some form of alternative data.

Underperformance against benchmark indices has been a long standing challenge of the active investment funds.

They are hoping that alternative data can give them some ‘edge’.

But usage of alternative data is not just restricted to generating alpha.

Data sets can also be used more like insurance — information to help limit loss in the face of potential upheaval. For instance, Thinknum (an alternative data provider) saw “unprecedented” inbound demand when, at the height of the GameStop saga, it released its Reddit Mentions data set — which tracks, in real time, how often ticker symbols are mentioned in the top 100 posts on r/WallStreetBets and r/Stocks.

It was alternative data as risk management. If a hedge fund was shorting a stock, here was a way to maybe know if a short squeeze was imminent.

While the opportunity is very large, asset managers will need to keep hunting for new and innovative sources of data as well as its usage.

The value of data will often decay over time and with more and more usage - what creates alpha today will be a commodity tomorrow.

Thank you for reading! Please share it with people who you think might find it interesting :)

You can also follow me on Twitter here.